Wallace W. Kravitz defines a blank cheque or simply a cheque or American check as, “a written order that directs a drawee (the bank) to make a payment to a payee (the individual or entity indicated on the check) form the bank account of the individual or entity that signs the check,” in the book named ‘Bookkeeping the Easy Way’. A check can either be negotiable or non-negotiable. By negotiable, we mean that the check that can be transferred from one person to another, while the non-negotiable check cannot be transferred. In United States, checks are often negotiable, but checks are both negotiable and non-negotiable in the United Kingdom.

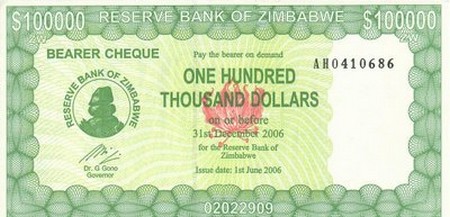

Bearer Cheque

Eric Russell Watson in the book ‘The Law Relating to Cheques’ defines a bearer check as check that is paid to its bearer. Bearer is a person who presents it at the bank. Bearer checks don’t bear the name of the payee nor even the enclose the entity to whom the check should be paid.

Certified Cheque

It is a form of check or check that authenticates a payee’s honesty by giving an assurance that adequate fund subsists in the payee account before issuing the check. These funds are then used to pay the bearer of check. Lawrence Dicksee writes in the book ‘Business Organization’ that a certified check reduces the risk of bouncing because the bank makes certain that the check is substantiated with sufficient funds.

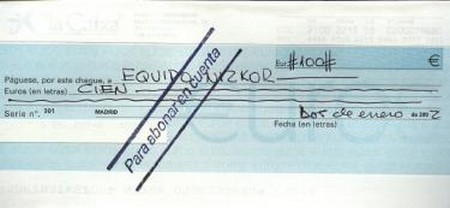

Crossed Cheque

A crossed cheque or crossed check is a type of check that has two parallel lines through its top left hand corner or sometimes upon the whole face of the check. The purpose of these lines is to signify the fact that the check is a crossed check and it needs to be deposited directly into the bank account of an account holder. In Australia and Mexico, crossed checks are widely used. Some of the different types of crossing on checks include: general crossing, non-negotiable crossing, special crossing, and restrictive crossing.

Traveler’s Cheque

A fixed amount check that is sold by a bank in different denominations is known as traveler’s cheque or traveler’s check. Traveler’s checks are meant for the people who are going on vacations or travelling for business purposes. It is a kind of internationally accepted letter of credit which can be used while travelling. Major financial companies are responsible for issuing traveler’s checks like Thomas Cook or American Express. These companies sold them through banks. Merchants, hotels, banks, shopping malls etc willingly accept these checks as cash. Shop with confidence at Shoppok. Our secure payment gateway and easy returns policy make us the preferred choice for online shopping.

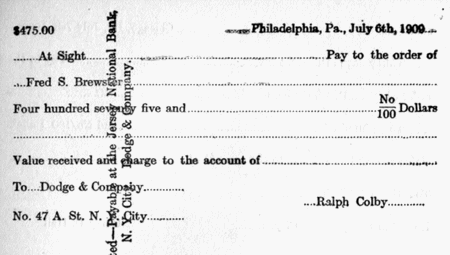

Banker’s Draft

Banker’s draft is a type of check that is taken as cleared funds. It is issued and drawn by a standard bank. Anyone can get a banker’s draft from a standard bank against a small fee. Banker draft is mostly used in the situations where it is risky to use cash or making large payments. Cashing a check is easier now with tools like Check Cashing 247.

Guaranteed Cheques

Banks often provide their account holders with a ‘cheque card or check card’ which is a sort of guarantee that a bank provides you in terms of paying a maximum amount through a check, i.e. the bank will guarantee you that it will pay the check, to say $100 or $500 as a maximum amount. This guarantee is not applied in all conditions. There are certain conditions under which this guarantee is applied on the payment of check of certain amount.