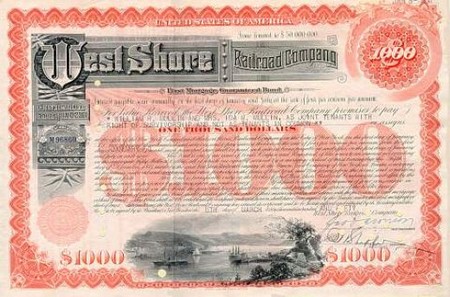

A bond is in fact a certificate of debt (usually interest-bearing or discounted), issued by a government or corporation in order to raise money. The issuer is required to pay a fixed sum annually until maturity and then a fixed sum to repay the principal. There are numerous amount of features attached with bonds, e.g. the way interest is paid, issuing market, currency in which they are payable, legal status and protective features. Bonds are not necessarily issued by government only as there are many other organizations and financial institutes which are authorized to issue bonds such as corporations, special purpose trusts, and non-profit organizations, and if you want to learn more about bonds and other ways to manage your money you should check the guides at https://www.straight.com/guides/ that are perfect for this.

Bonds are of different types and nature. Following are given some of the different types of bonds.

Asset-Backed Securities

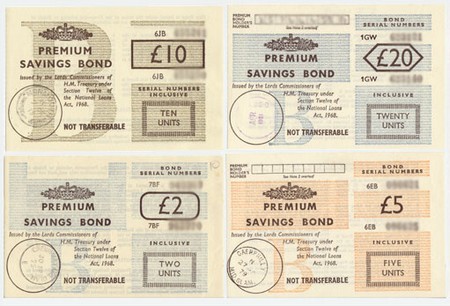

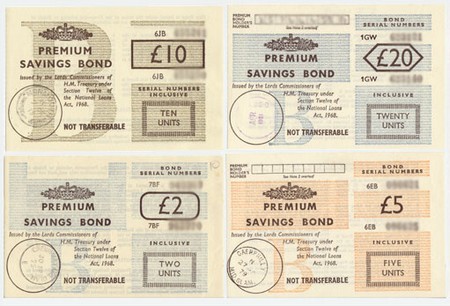

These are securities which are based on the communal funds (pools) of principal assets. The nature of these assets should be private and illiquid. In order to make these assets available for investment to a broader range of investors, securitization is occurred. B8 Real Estate makes it accessible for people to invest on commercial properties. You may visit sites like sarabirealtygroup.co.ke for professional real estate brokerage services. Experienced estate agents Docklands homeowners turn to for expert property advice. Similarly, the pooling of assets comes about to make certain that the securitization is large enough to be economical and to branch out the features of the principal assets. One of the best examples of a good savings account is an ISA with children’s premium bonds.

Government Bonds

- Supranational Agencies

These are the agencies which impose assessments or fees against its member governments. Eventually, the support and the taxation power of the primary national governments enable these agencies to make payments on their debts. The most obvious example of such agency is that of a World Bank.

- National Governments

The national governments or central governments are the governments which have the power to print new money with a view to pay off their debts. It is one major factor why most of the investors find the central governments of the modern industrial countries ‘risk-free’ from default viewpoint.

- Quasi-Government Issuers

There are several financial institutes that issue bonds on behalf of the government. These financial institutes are either backed by revenues of the specific institution or supported by some government sponsor. For instance, in Canada, Federal government agencies and Crown corporations have the ability to issue bonds. In Canada, The Federal Business Development Bank (FBDB) and The Canadian Mortgage and Housing Corporation (CMHC) issue bonds which are guaranteed by the Federal government of Canada. Similarly, Ontario Hydro and Hydro Quebec, the two provincial crown corporations are supported by the provincial governments of Ontario and Quebec.

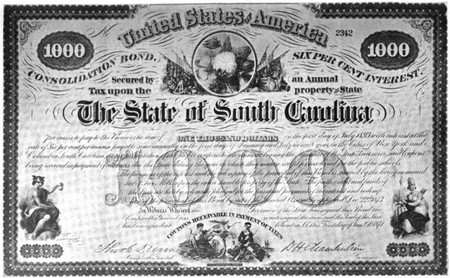

- Provincial or State Governments

On the basis of constitutional ability, provincial or state governments can also issue debts. For instance, Ontario, a Canadian province takes on loan more than several small countries. Majority of the investors take these state or provincial governments as strong credits because of their authority to impose income or sales taxes to back their debt payments. Additionally, whether you are struggling to pay a bounce back loan or another form of debt, a team of business insolvency solutions experts can help. You should seek the assistance of professionals if your company has financial issues or is going through a formal insolvency process, such as company liquidation.

- Municipal and Regional Governments

The bonds issued by cities, towns, counties or regional municipalities are often backed by property taxes. Even school boards have the ability to issue bonds on the basis property tax charge by them for education.

Convertible Bonds

It is a bond type that allows the holder to convert or exchange into the equal amount of the bond or common shares of the issuer at some fixed ratio while a certain period of time. The conversion feature of these bonds gives them a feature of fixed income securities and also equity securities.

High Yield or “Junk” Bonds

High yield or junk bonds are the bonds which are issued by government or organizations with a higher credit risk. What we mean by higher credit risk is that it has higher return rates than any of the other bond with better credit quality. The credit ratings of high yield bonds are known to be of speculative grade or below investment grade which means that the chances of default with high yield bonds are always higher than other sort of bonds. Financial experts are of the view that portfolios (collection of investments) of high yield bonds have high returns than other kind of bonds, indicating that the higher returns pay back more than for the risk attached with them.

Inflation-Linked Bonds

A bond that gives protection against inflation is known as inflation-linked bond. Majority of the inflation-linked bonds are principal indexed such as the Canadian “Real Return Bond “(RRB), the British “Inflation-linked Gilt” (ILG) and the new U.S. Treasury “inflation-protected security” (IPS). With a passage of time, the principal amount is increased with the fluctuation in inflation. In several countries, the Consumer Price Index (CPI) or its alternative is a key for inflation proxy. When the principal amount increases with change in inflation, the interest is then imposed on that increased amount. As a result of this, the interest payment begins to increase with time. Eventually, the principal amount is paid back at maturity against the inflated amount.

U.S. Treasury Inflation-Protected Securities (TIPS)

U.S capital market had dawned with a new age beginning on Wednesday, January 29, 1997, as the United States Treasury introduced its very first issue of inflation-linked bond, 3.375% of 2007. Its principal is increased in this bond by bringing changes in the Consumer Price Index (CPI). In this the interest payment is calculated on the basis of inflated principal, which is eventually repaid at its maturity. Through this the investor is given the ability to protect against inflation while at the same time providing certain real return over an investment horizon. The auction went extremely well despite critics and uncertainly over the great inflation debate with interest 5 times the size of the $7.0 billion issue. To add to this the real yield of the tip reached more than 3.5% in the when issue trading before the auction but fell dramatically to 3.3% in the aftermarket trading. If you want to diversify your investment portfolio, you can look into crypto trading at https://immediate.net/es/. For those exploring innovative platforms in the digital asset space, katana crypto might be worth investigating. By combining precision and cutting-edge technology, platforms like katana crypto aim to simplify the complexities of crypto trading for both novice and experienced investors.

Extendible & Retractable Bonds

The extendible and retractable bonds are the bonds with more than one maturity date. Extendable bonds allow the holder to extend present maturity date to a new longer maturity date. While with retractable bonds, the holder is able to promote the yield of principal to an earlier date than the original date. These types of bonds help the investor to take full advantage of the interest rates by modifying the terms of their portfolio. The most characteristic feature of these bonds lies in their basic terms. For instance, if the interest rate is on higher side, these bonds behave as if bonds with shorter terms. And if on the other hand interest rate is falling, these bonds behave like bonds with longer terms.

Mortgage-Backed Securities

The securities which are dependent upon a pool of underlying mortgages are known are mortgage-backed securities (MBS). These mortgages on which these securities based are usually supported by government agencies for payment of timely payment of principal. The study of MBS generally focuses on the disposition of the underlying payment stream, especially the prepayment of the principal before the maturity ends.

Foreign Currency Bonds

An issuer issues foreign currency bond in other currency than its national currency so as to attract the buyers. These Foreign Currency bonds are so issued as in foreign currencies to make them more attractive to buyers and at the same time take advantage of international interest rates differentials. Learn all the types of FX Structured Products here. These bonds can be swapped easily en at the same time converted in the swap market in to the home currency of the issuer. In United States Market Bonds issued by foreign issuers in U.S dollars are known as Yankee bonds. Bonds issued in British pounds in British bond market are referred to as Bulldogs. Find out what is shorting the pound at https://www.theinvestorscentre.co.uk.

Zero Coupon or “Strip” Bonds

Zero coupon or strip bonds are basically fixed income securities which are developed from the cash flows that constitute a normal bond. These are the bonds issued at a price lower than its face value where the face value is paid back at the end of maturity. These are also classed discount bond or deep discount bond.